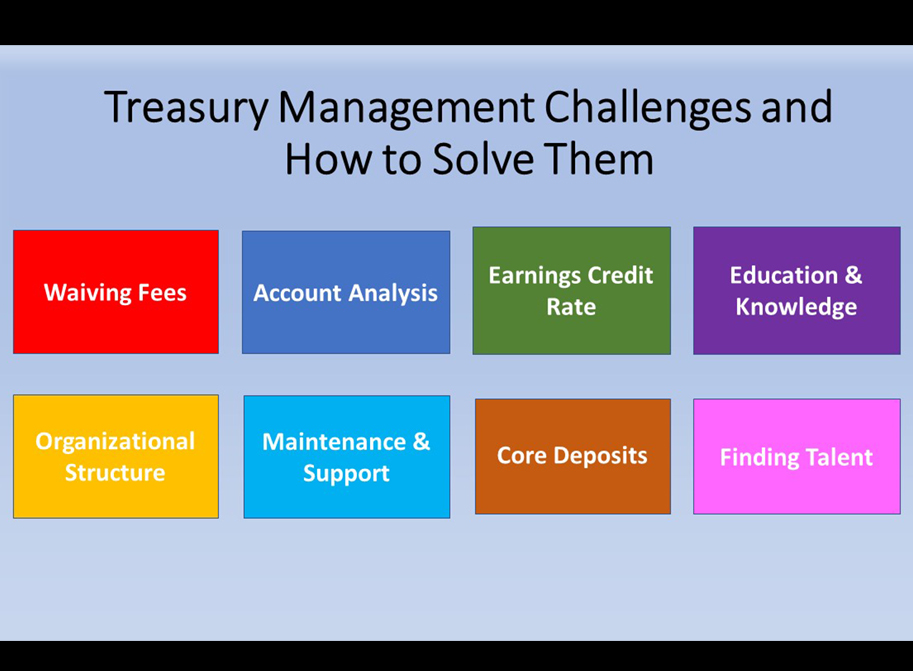

Are you wondering how to deal with your top treasury management challenges and how to solve them? You’re not alone. In this three-part article, I share the top challenges that treasury management officers (“TMOs”) face and provide you with ideas on how to deal with each one. Part I addressed the top two challenges: waiving fees and the importance of turning Account Analysis System on. In Part II we addressed the challenges with the ECR, lack of education on Treasury Management, and the organizational design for TM department. Let’s continue with the last three top challenges:

Challenge #6: Lack of ongoing maintenance and support for existing business customers or members.

Ideally, your institution has a formal sales process that leads to product implementation and ends with the established customer or member ongoing support and maintenance. Many institutions have not formalized any of these three important processes. Therefore, there is confusion as to who should do what during the onboarding and ongoing support of TM customers.

Solution: Establish a formal sales process that flows from a customer or member onboarding to TM product implementation. Clearly define roles as to who provides the ongoing support and maintenance of TM business customers or members.

Challenge #7: Thinking you don’t need core deposits.

Due to the government relief and Paycheck Protection Program (PPP) during the pandemic, most institutions, regardless of size, had excessive liquidity levels. However, that ended. We are back to the times where institutions fight for core deposits. Now Fintechs compete with banks and credit unions for core deposits.

Solution: Ensure you bring the depository side of the business as you onboard loan customers. Focus on both sides of the balance sheet—assets and liabilities. Treasury Management is one of the best kept secrets to bring additional core deposits. TM products glue your business customers or members to your institution. Additionally, if you make it easy to join your institution and glue them with TM products, they will not want to leave!

Challenge #8: Lack of talent in the market.

Treasury Management professionals are scarce. Every institution I know is looking for one.

Solution: Keep a pipeline of potential candidates that could join your institution in the future. The other option is to train from within. The best candidates for TM sales come from business banking, private banking, or universal bankers who show interest in working specifically with businesses. The best candidates for TM operations come from deposit operations, electronic banking, or core system gurus.

I encourage you to educate your entire staff on treasury management. When everyone understands the value of treasury management products and services (to increase core deposits and non-interest fee income), you acquire a competitive advantage over your competition.

I hope the solutions presented here are helpful to you on your quest to deal with the top treasury management challenges and how to solve them.

Looking for ideas to expand your Treasury Management reach to new business customers? Look into the TMClarity Framework, our comprehensive and transformative training and Treasury Management business management system that leads to greater sales success, higher margins, and increased customer retention in a competitive marketplace.