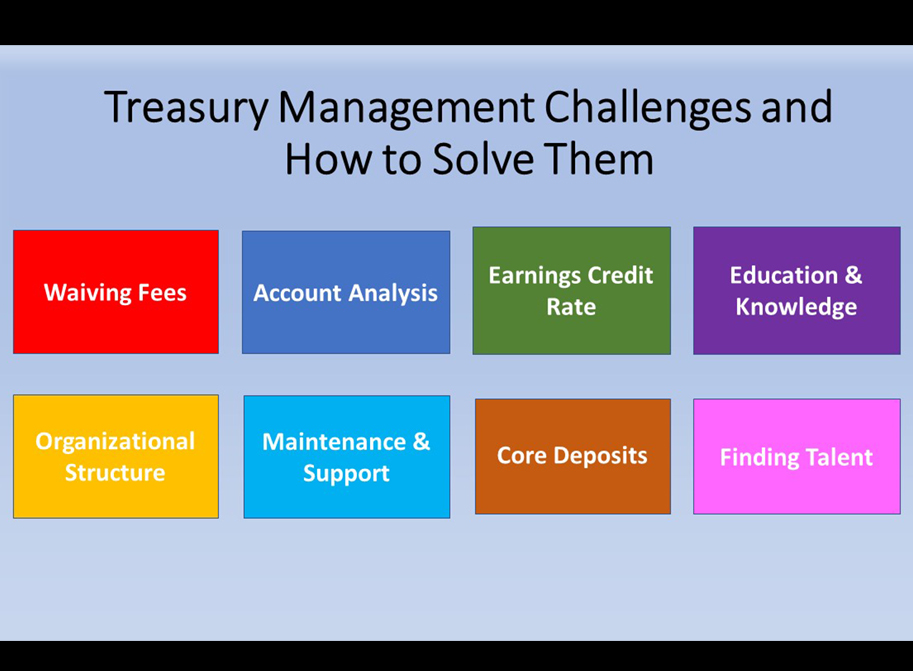

Are you wondering how to deal with your top treasury management challenges and how to solve them? You’re not alone. Community banks and credit unions around the nation experience similar challenges in their Treasury Management departments. In this three-part article, I share the top eight challenges that treasury management officers (“TMOs”) face and provide you with ideas on how to deal with each one.

As I work with community financial institutions around the nation, the top concern I hear is “The bankers are giving away treasury management services.” One institution’s TMO shared once, “Marcia, every time they give away our products and services, they’re telling us we don’t matter.” Wow! That comment got to me. So, I am purposed to increase visibility and create awareness of the value of treasury management services. Allow me to start with the top two challenges:

Challenge #1: Waiving all (or most) treasury management fees.

Waiving your treasury management fees creates two major issues in your institution. First, you’re missing out in an extraordinary source of non-interest fee income. One of my clients discovered the institution waived $1 million dollars a year in TM fees. That is unacceptable! Second, your employees’ morale suffers as the employees who support and sell TM products feel they don’t matter.

Solution: Stop waiving fees! That sounds like the right, simple solution, right? It’s not that simple. Charging for products and services that have been “free” takes a change in culture starting at the top. The president/CEO needs to acknowledge the value of TM services. One way is to allocate the appropriate resources to sell and support TM services.

Challenge #2: Account Analysis System is turned off.

Many institutions currently have the Account Analysis System (AAS) turned off . Therefore, they waive all the TM products or “hard charge” (meaning, directly charge the business checking accounts) for specific products used. Business customers do not like hard charges.

Solution: Turn Account Analysis system on. Imagine the AAS is your automatic billing system for your business clients. When it is turned on, a specific business checking account type triggers the core system to produce an account analysis statement monthly. This special “analyzed statement” is like an X-Ray of your business customer or member’s monthly activity. Therefore, the statement helps you identify cross-selling opportunities. You can also encourage your customer or member to increase their core deposits to cover their fees.

The Account Analysis system allows you to charge for all your treasury management products and services. Therefore, the only service that should be hard charged on the day of the incident is overdraft fees. Now businesses pay for all banking services (including account maintenance, checks written, deposited items, deposit tickets, etc.) with their core deposits! This is called “soft charging.”

We will continue with the next top Treasury Management challenges and how to solve them in Part II of this article. Stay with me as there are several other top challenges!

Looking for ideas to expand your Treasury Management reach to new business customers? Look into the TMClarity Framework, our comprehensive and transformative training and Treasury Management business management system that leads to greater sales success, higher margins, and increased customer retention in a competitive marketplace.