Accountability Chart Mastery (Part Three of Six). If your community bank, credit union, or non-banking business runs on the Entrepreneurial Operating System (EOS®) (or even if you don’t), the accountability chart is one of the most powerful tools to getting what you want from your business.

In part one of this series, we talked about what an accountability chart is and why it is important to have one. In part two, we addressed some stories with creating accountability charts. In part three of this series, we start reviewing some building blocks of accountability chart mastery.

Lets Fix This

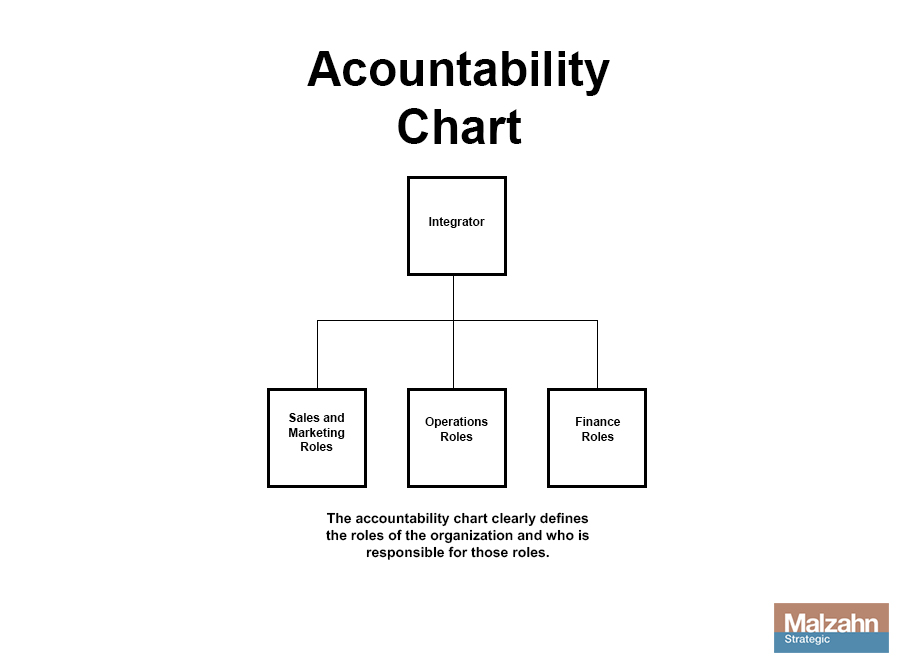

In the EOS world, building an accountability chart starts with the leadership team. It is based on the premise that there are basically three basic functions in an EOS organization: Sales/Marketing, Operations, Finance. In the EOS world, we add the role of Integrator, a role that integrates the three basic functions, keeping them on track and accountable. In some organizations, there is a Visionary, but many times in smaller organizations, the Visionary and Integrator are combined into a single accountability chart function.

Your organization may have more at the top level than the basic accountability chart explained here. In a community bank or credit union, some of the critical accountabilities at the top is those of a Risk Officer and a Chief Credit Officer and depending on your institution size, you may want those roles on the senior leadership team.

At the senior leadership team level, document the broad, general accountabilities each of the functions would have. For instance, the Sales and Marketing function would have:

- Setting marketing goals and holding the marketing team accountable

- Attracting the right customers to your sales team

- Presenting the right credit or deposit solution to your customers and closing the deal

- Setting sales goals and holding the sales team accountable to those goals

- After the sale service and support

Some organizations may put the customer experience under the sales function, some may put it under the Integrator function. Others may put it under the Operations function. In part 6 of this article, we’ll dive into some specific IT department accountabilities to get your chart going.

If you are working with an EOS Implementer, the accountability chart exercise will take a significant amount of time. If you are self implementing EOS as a senior leadership team, don’t underestimate the time it takes to get the leadership team accountabilities correct. Take the time, discuss each accountability honestly and openly and get it right.

In part four of our series, we address building out the senior leadership team level of your accountability chart.

Resources:

- Download free chapter of the book Traction by Gino Wickman.

- Download a free chapter of the book Rocket Fuel by Mark C. Winters and Gino Wickman

- Contact Us for more information about building out your Accountability Chart and implementing EOS in your organization.