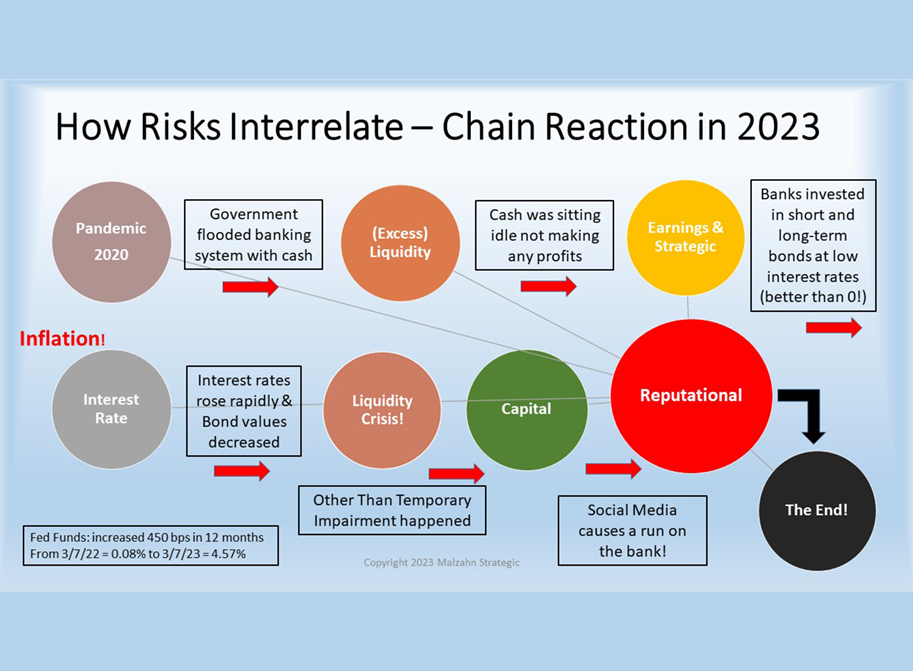

What happened with the recent bank closures in 2023 is all about managing all risks and tackling every aspect of risk—at the same time! As you can see from the various events that led to the closure of several banks, one type of risk led to another in a chain reaction until the regulators closed their doors.

One of the most important things to know about Enterprise Risk Management is that all the risk categories are interrelated. This means that when your institution experiences one type of risk, immediately, or simultaneously, you will experience another type of risk.

Chain of Events

When the Pandemic happened in early 2020, (see blog about how the Pandemic affected all other risk categories), the government’s reaction was to provide the biggest cash stimulus in the history of the country. With the extraordinary influx of cash to individuals and businesses, the financial institutions encountered a tidal wave of cash which represented an “excess” of liquidity (risk). This cash was sitting idle not making any profits for the institutions which led to earnings risk. Then most institutions decided to invest the excess cash, and many chose government securities. The decision of how much to invest, for how long, and in which investments was a crucial management strategic decision and thus strategic risk.

The Decision’s Consequences

Unfortunately, many institutions of all sizes made the wrong decisions. They invested too much of their excess cash for too long of a term, not in a laddered maturity structure, and at extremely low interest rates. But that was better than making zero money on the extra cash, right? However, as a result of the government stimulus, inflation happened. Now, to combat inflation, the Fed started raising interest rates (interest rate risk) at such fast pace that institutions quickly found themselves upside down on the value of their bonds. The Other Than Temporary Impairment (OTTI) happened, and institutions’ balance sheets now showed millions, and for some billions, of dollars in unrealized losses.

This situation became now a liquidity (risk) crisis for certain institutions, and they experienced capital risk when they had to realize the unrealized losses from the sale of their securities. Lastly, when word got out that certain institutions were in need of raising additional capital, the bank experienced a run on their deposits. This is a perfect example of reputation risk. In the end, reputation risk is what sealed the fate of these institutions.

Your Reputation Risk

Your reputation is your most priceless possession, and you must protect it at all costs. You protect your reputation when you establish strong policies, procedures, and safeguards in all areas of risk. You then ensure none of the risk categories start a chain reaction that could end your existence. This blog is a simplistic way to explain what happened to certain regional banks that experienced several risk categories one after another and almost simultaneously for some risk categories.

This catastrophic event serves as a perfect example on how it’s all about managing all risks—at the same time. This is the “M” in the CAMELS ratings that regulators focus on to ensure your Board of Directors and senior leadership—management—can in fact manage all the potential risks your institution faces now and in the future. As an emergency reaction, the government stepped in and created a new program called “Bank Term Fund Program” (BTFP). But institutions must be cautious on using this new liquidity funding source because it may imply a liquidity weakness which creates immediate reputation risk.

The Tone at the Top

Can the Board of Directors and senior leaders tell your institution’s story from the risk perspective? Do you know your unique risks such as portfolio concentration, depositors/relationship concentrations? Do you allocate the appropriate resources to ensure your institution is truly safe and sound from every risk category? Is ERM an afterthought at your institution or is it a monthly Board meeting agenda conversation? The “tone at the top” is crucial to identify, assess, mitigate, monitor, and report all your risks. I encourage you to complete and formalize your ERM Program.