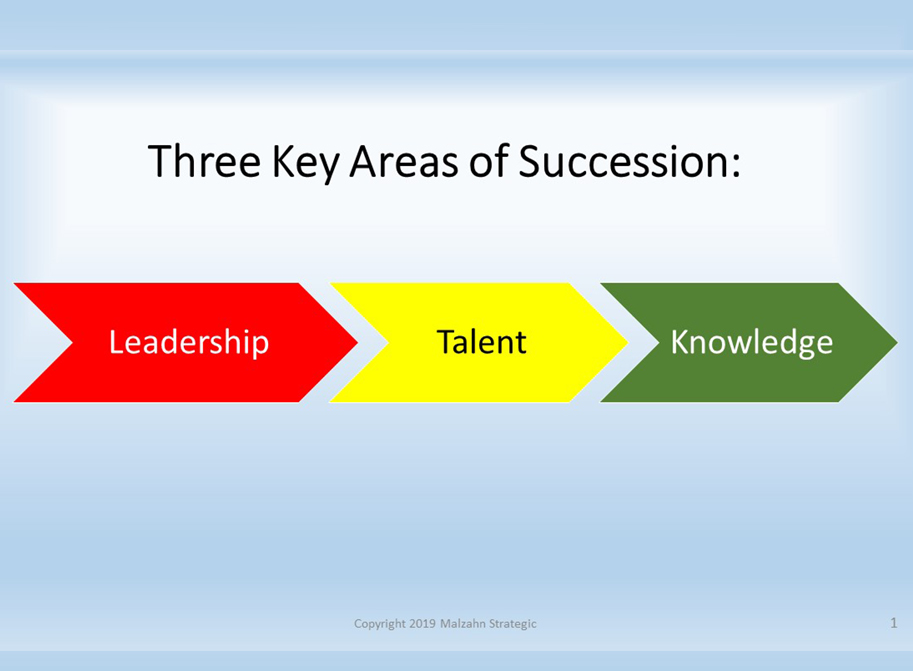

Succession planning is important and are you addressing it in your organization at all levels and from the various perspectives? Below are three key areas of succession planning you need to focus on:

- Leadership succession planning: Typically, this is the area that gets the most attention—especially the top leadership positions such as the Board of Directors, CEO, President, and the other “C Level” leadership positions. However, focusing on the next level of management as well as the key non-management positions occupied by what I call “legacy employees” is crucial to successfully implementing a succession plan.

- Talent succession planning: Here I refer to “talent” as the specific gifts and talents that your employees possess that will be leaving your organization as they retire. For example, you may have an employee who’s very talented at understanding the specific markets you serve. Another employee may be talented at the human resources side of the business. They have built a culture of inclusion and respect that may be hard to find. You may have another team member who is talented at understanding technology way deeper than the normal “user.” He or she is the one that everyone asks for help and they also have the communication talent to help others in addition to the technical talent. Replacing talent is different than replacing knowledge as you can get a new employee who is experienced in technology but doesn’t have the talent of communication, for example.

- Knowledge succession planning: In addition to developing a plan for the leadership positions and replacing key talent exiting your organization, you need to also plan for transitioning the knowledge from the exiting workers to the new ones.

When focusing specifically on the knowledge succession, there are three distinct areas you need to address. These areas of knowledge are equally important when considering the wave of knowledge that is exiting the workforce.

- Business knowledge: Refers to the business knowledge which typically resides at the leadership level of the organization. Are you training your emerging leaders (in every area) on how to run the organization as a business? Are you sending them to specific training schools for your industry? For instance, when I attended the Graduate School of Banking, I noticed that most of the students were lenders, but institutions may be forgetting that the other leaders coming from operations, technology, treasury management, HR, finance, and marketing also need training. They all represent critical areas of the business of banking. You will have a better team when the leaders of all key areas understand and value the other areas of the organization.

- Specific technical knowledge of your industry: In the banking world, each area requires years of experience to learn as there are no specific certifications to become an expert in deposit or loan operations or the core system “gurus,” for example. There is also the extensive lending knowledge that some bankers have acquired over the years in areas such as commercial real estate, construction and development lending, small business lending (SBA), or Commercial and Industrial (C&I) lending. And there is also the Treasury Management and Cash Management expertise that every community financial institution seems to be looking for to grow core deposits and increase non-interest fee income. Currently, there are only two or three universities in the nation that provide a four-year college degree in “Banking.” Even though you may not be in the banking industry, this specific technical knowledge is exiting your organization too.

- Relationship knowledge: Passing along the knowledge of “knowing your customers” is crucial when addressing the succession planning issue at your organization. How are you preparing to successfully transition the relationships built over 30-40 years of employee/customer relationships? Make sure to include this part of the succession planning as you start transitioning relationships to the new employees. This includes sharing not only about the types businesses you serve but also sharing about the customer’s family history, places they like to eat, best way to stay connected with them, and how they like their business handled (i.e. in person, phone calls, emails, text, etc.).

An effective succession plan involves the investment of time, money, and resources. Therefore, when your organization invests in developing its successors, are you considering the following areas of “Return on your Investment”? Are you keeping the employees accountable for the resources of time and money you’re investing in them as the future of your organization? Below are three ways to explore this concept:

- ROI on training: Education and training is expensive but necessary in order to not only retain your current talent (employees) but also to develop the newly acquired talent. But do you have a culture where employees appreciate the investment your organization is making in them? Ensuring employees don’t have an entitlement mentality and making them aware that your investment requires a return is part of keeping your employees accountable.

- ROI on mentoring: Establishing a formal mentoring program takes a lot of time and personal effort from the mentor especially. The mentee needs to respect the mentor’s time and make the effort to really learn from the mentor. This attitude encourages the mentor to continue investing his or her time with the mentee. The mentee in turn learns more and it will be a rewarding experience for both parties.

- ROI on experiences: When your organization invests in sending employees to conferences or special certifications (i.e. compliance certifications, industry specific conferences, industry certifications, HR certifications, etc.), you should expect a return on that investment as well. These employees are gaining not only the certification itself but also the experience of being with other professionals and colleagues. They also gain from the networking that happens naturally at these events—especially since they are outside the organization.

Below are strategies to address the succession gap in the areas described above:

- Establish a mentoring program as part of your Talent Management Program. Get serious about pairing up employees who are mature business leaders with the up and coming leaders of those areas and the new employees. The mentoring should include all three areas of knowledge: business, technical, and relationships.

- Establish a “reverse mentoring” program as well. The reverse mentoring works the opposite of the regular mentoring program where now the younger employees mentor the older employees specifically on technology-related activities. For example, you can pair up a young mentor with an older employee to teach them how to use new capabilities from your CRM system.

- Ask employees who attend conferences to present to the team who may benefit from the newly acquired knowledge. At the minimum, they could write an “Executive Summary” of what they learned and share it with the team.

- Invest in the “soft skills” such as training on leadership talent and management skills development (notice that leadership is a talent and management is a skill). Invest in the other skills that are crucial for all employees to succeed—especially those in leadership—such as negotiation, communication, presentation, and presence skills.

- Most importantly, establish a culture of continuous improvement and learning where everyone is cross trained on other duties and everyone has a backup.

- If you are the recipient of the mentoring and training, are you paying it forward? Are you sharing the information learned with the rest of the team?

I hope some of these concepts and ideas are helpful to you as you prepare your Strategic Plan which includes your Succession Plan for your organization.